Probate valuation simplified

)

Movewise presented a talk based on this article at LegalEx Spotlight on Wednesday March 31. You can now view this session on demand here.

View the original article here or by visiting Movewise's website.

Valuing probate property accurately is vital to ensure that the total value of the estate can be reported to HMRC for inheritance tax purposes. However, achieving this can be challenging, both for solicitors who may be managing multiple probate estates at once, and for individual executors who might be managing unfamiliar legal processes at an already difficult time. Here’s why outsourcing the process makes sense.

It’s well known that some of the main reasons for selling property are the “three Ds”: death, debt and divorce. Focusing on the first of these, it is estimated that one in 10 properties on the market in the UK is sold under probate as part of a deceased person’s estate.

Before the executor of an estate can apply for probate, they need to assess the value of the money, property and possessions that make it up. Where the total gross value is more than £250,000 - which is highly likely if a residential property is part of the estate - then professional valuation is required for any items worth more than £1,500.

Inheritance tax (IHT) is only payable when the net value of the estate (after debts and funeral expenses have been paid) exceeds the “nil-rate band” of £325,000. Only about 5% of estates in the UK are liable, but the inheritance tax paperwork still has to be completed in about 50% of cases: some 275,000 estates each year.

If HMRC suspects that an estate has not been valued accurately, it can launch an investigation - and this has become more common in recent years. In 2019-20, it investigated one in four estates that were liable for IHT: more than 5,000 cases. These investigations resulted in additional tax charges of £274 million, or almost £50,000 per case. As well as causing additional cost, this results in delay in the settlement as well as distress for the beneficiaries and risk to the professional reputation of the solicitor. If the shortfall is significant, it could even result in criminal charges and a custodial sentence.

Obligations for probate valuation

Section 160 of the Inheritance Tax Act 1984 specifies that the valuation should reflect the price the property would reasonably expect to achieve if sold on the open market at the date of death. HMRC’s guidance states that the executor should make the valuer aware of any information that might affect the likely price of the property. The valuation should also take into account any development potential, even if planning permission has not been sought or granted. A lower valuation for probate may lead to higher capital-gains liability later if the property is sold for development.

It is important that the valuation does not specify that it is a probate valuation. Historically such valuations tended to discount the open market value by around 10%, which may raise concerns at HMRC.

Challenges of probate valuation

In many cases, the solicitor will also be the executor, and so will be responsible for obtaining property valuations. This can present a number of challenges:

- Finding appropriate estate agents. The property may not be local to the solicitor, so knowledge of the area may be lacking. For more unusual properties, using a national chain might not be appropriate.

- Ensuring that the valuation is suitable. The rules on valuation are strict, so the valuation provided by an agent must be performed appropriately and have the proper wording to satisfy HMRC.

- Co-ordinating multiple properties. Dealing with estate agents generates administrative hassle. Dealing with several agents for several probate properties multiplies the red tape.

In other cases, the executor may be one of the beneficiaries of the will. Often they will have little or no experience in legal matters, and may be daunted by the process on top of dealing with bereavement. Executors applying for probate themselves are more likely to make errors which can delay settlement or increase costs.

Additional challenges include:

- Confusion over valuation obligations, and the distinction between inheritance tax and capital gains tax

- The hassle of finding a suitable agent or surveyor, collating the documentation and submitting it in the appropriate format

The solution

Movewise was founded by Tom Scarborough after he grew frustrated with selling his own property and thought there had to be a better way. Since then we have pioneered a unique managed multi-agent selling process which has proved extremely effective. We’ve listed property worth more than £110 million, and we have the highest sales rate and lowest price reduction rate of any pan-UK estate agent. Now we are using our experience to offer valuations and sales management to the probate market.

The Movewise sales model is based on choosing the best agents to sell any home, so our experienced property team can be relied on to choose the right agents to value a property anywhere in the UK. We then co-ordinate multiple valuations, working closely with the agents to ensure that the valuations provided are in the correct format and contain the necessary information to satisfy HMRC.

As soon as we have collated all the information we provide a full valuation report, along with our recommended sales approach, which can be shared with executors. All of this is achieved through a single sales contact at Movewise, however many agents are involved. If required we can also arrange a RICS “Red Book” valuation by a chartered surveyor; unlike agents’ valuations, which will typically be free of charge, Red Book valuations have an associated cost, which will depend on the size of the property.

How it works

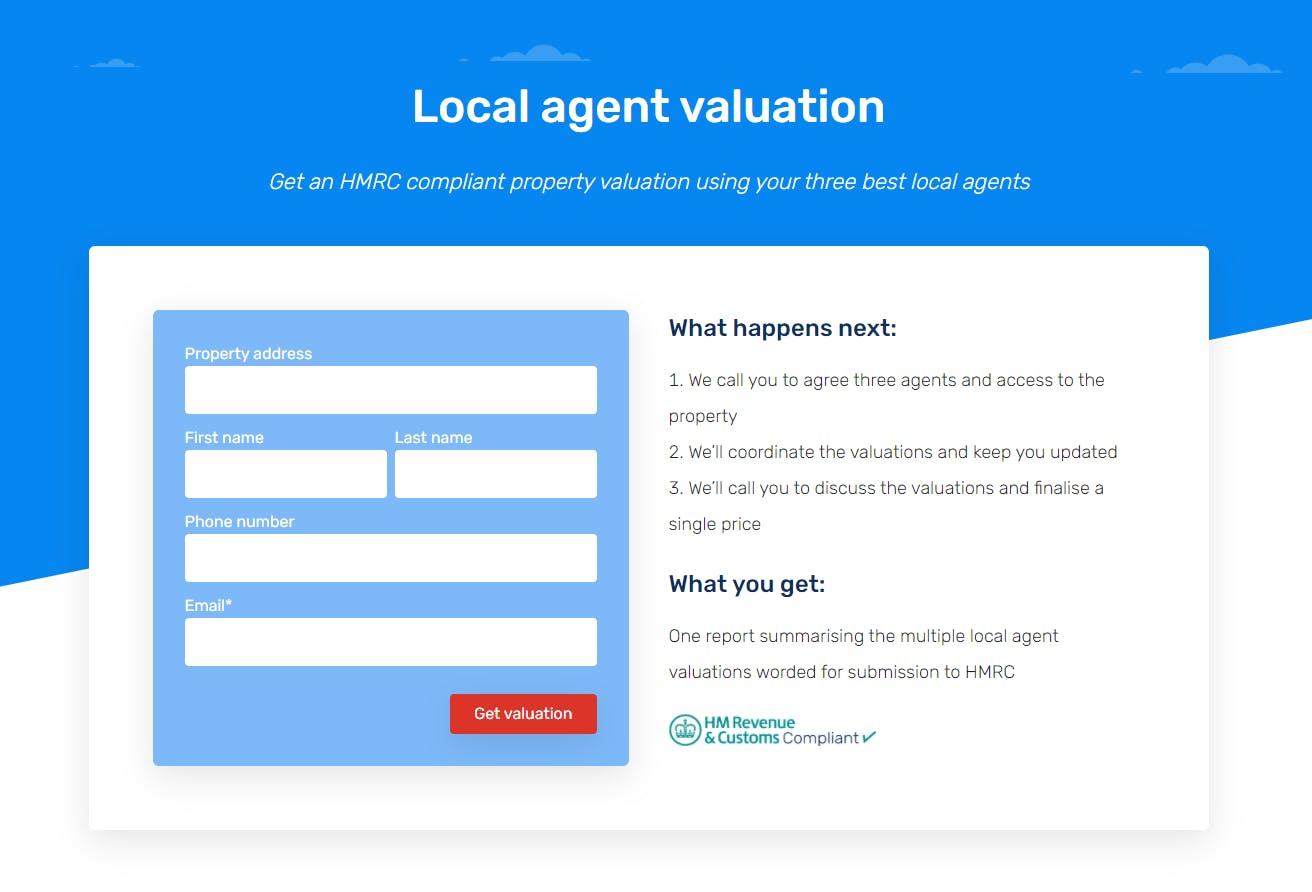

Both solicitors and executors can access the valuation service directly through our website using the “Get a valuation” button. This takes the user through to either a regular valuation or probate valuation option. The regular option is for conventional non-probate sales, while the probate option ensures that valuations are fully HMRC compliant.

For probate valuations, we will identify the best local agents relevant to the type and price range of property, or an appropriate surveyor, if a Red Book valuation is required.

Whichever of these is chosen, the user simply needs to provide some basic contact details and the property address. In the case of an agent valuation we will run our “best agent report” which identifies the best agents to sell the property and therefore those who are likely to be the appropriate ones for valuing it. We will then contact the executor or solicitor to collect further information, talk them through the proposed process and arrange access.

Once we have the valuations, we summarise them in a consistent format and make this available as a shared document, so that all interested parties can easily be kept informed.

At this stage we will also provide a suggested marketing strategy for the property if it is likely that it is to be sold. This is free of charge and entirely without obligation.

A seamless sales process

While we are happy to offer this valuation service with no obligation, if the property is to be sold then our expertise also offers a number of advantages.

Unlike traditional sales, where the seller must negotiate with agents directly and risk being tied into a long exclusivity agreement, Movewise quotes a single fee for coordinating our managed multi-agent sales service. This means that the listing can easily be moved from one agent to another if a sale is not achieved, at no additional cost. Our fee averages 1.5%+VAT: typically the same as a regular sole agency fee, and in the case of prime properties in London often lower. All fees are due only on completion of a sale and there are no hidden charges.

As well as outperforming traditional agents, our sales process also cuts down on red tape. Clients sign terms and conditions, electronically, with us once only. We then negotiate with the local agents, achieving much better terms than the client would get if they contracted an agent directly. For solicitors managing multiple sales, there is the additional benefit that a single account manager at Movewise handles all the transactions, providing a single point of contact and saving time and paperwork.

Probate property comes with other unique challenges, which Movewise can assist with. We can arrange vacant property insurance and assist with other tasks such as house clearance, and meter readings. We also have arrangements with finance providers who can provide loans to the estate to cover service fees and other costs if required.

To find out more about how Movewise can help make probate valuation simpler, contact us today.